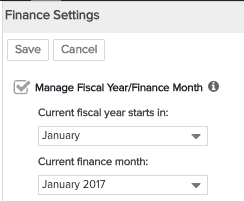

Fiscal Year and Finance Month

You can decide to designate a Fiscal Year and a Finance Month by enabling the Use Fiscal Year/Finance Month setting. Both of these fields impact calculations in Labor/Non-Labor reports.

Fiscal Year

For example, if your fiscal year starts in July and you're reporting for July 2016:

-

calendar month = 7, fiscal month = 1

-

calendar quarter = Q3/2016, fiscal quarter = Q1/2017

Finance Month

Project estimates are driven by the finance month. When you close out a month, you advance the finance month.

Finance month comes into play when you want to report on current estimates, which are comprised of actuals (up to the financial reporting date) and the forecast for the remainder. For example:

|

Field Name |

Date < Cut off Date |

Date >= Cut off Date |

|---|---|---|

|

Labor Cost Estimate Total |

Labor Cost Actual Total |

Labor Cost Forecast Total |

|

Non-Labor Cost Estimate Total |

Non-Labor Cost Actual Total |

Labor Cost Forecast Total |

|

Cost Estimate Total |

Cost Actual Total |

Cost Forecast Total |

If Finance Month is not enabled, the following dates are used (based on reporting frequency):

-

Daily Frequency: Cutoff Date is today

-

Weekly Frequency: Cutoff Date is week start date

-

Monthly Frequency: Cutoff Date is month start date

-

Quarterly Frequency: Cutoff Date is quarter start date

-

Yearly Frequency: Cutoff Date is year start date