How to Run an Ideation Market

- Last updated

- Save as PDF

Overview

This article provides a How-to guide for the Ideation Capitalist.

Considering Ideation Markets

Expand the sections below for information about ideation markets, how to set them up, and options for configuring them.

How It Works

A Word to the Community Member

Your Planview IdeaPlace community can operate as a marketplace of ideas: a place where your fellow members and you can buy, sell, and invest in ideas that resonate with you, that you find compelling, and that you believe the community will implement.

If you invest wisely, if you invest in the community equivalent of Google and not Enron, then your shares in the ideas will increase in value, peaking when the organization decides to implement them. Specifically, IdeaPlace converts the shares that you earn when the community closes the idea in question successfully to units of currency which you can use to redeem for items in the store on the site.

You can earn substantial currency when you invest early in ideas which the community ultimately decides to approve, but which initially have a lower probability of being implemented or closed successfully, as a function of their pulse rate. On the other hand, you forfeit currency when the demand for the ideas in which you invest decreases or when the community close them unsuccessfully—the corporate equivalent of investing in an idea that goes out of business. Likewise, the 100 units of currency that you invest represent 100 units that become unavailable to you to redeem at the store.

Bottom line? Invest wisely. You face real and opportunity costs as downsides.

A Word to the Community Sponsor

People who sponsor ideation initiatives or challenges within an initiative ask themselves if they should incorporate an ideation market into their community. The answer: yes. This section explains why.

IdeaPlace software offers a robust set of capabilities by which members of your community can engage one another on their ideas. Capabilities include voting on ideas, commenting, voting on comments, reviewing, forming teams around an idea, and building wikis to establish a body of knowledge around an idea. By using these tools the community members provide enormous value to the idea owner and, by extension, to the initiative: their engagement helps the owner to evolve their initial thinking from the point at which they first contributed their idea to the point at which the community decides whether or not to implement the idea. It’s often the case that the idea the community implements bears little resemblance to, and represents a considerable improvement of, the idea that the owner first submitted.

However, this approach has a disadvantage—a drawback that the implementation of ideation markets can help you overcome—the agency dilemma. The agency dilemma posits that agents—people employed to work on behalf of an organization—may at times put their personal interests ahead of the interests of the organization they ostensibly are in place to serve. Incentivizing executives by compensating them based on how well the organization that they manage performs represents an attempt to ameliorate the agency dilemma, for example.

In an ideation community, the agency dilemma may arise, for example, when a member suggests that moving to a two-day work week would give employees the requisite time to innovate, generating a tidal wave of compelling new business ideas for the company’s benefit. Leaving aside the merits of the idea in question, you can imagine how the larger community may feel compelled to rate the idea highly, regardless of whether the organization could, in reality, continue to operate with its employees out of the loop five days of the week.

By comparison, in an ideation market community members must consider which ideas they think the organization will graduate to later stages in the funnel and ultimately implement. Their decisions generate market data that provide two enormously valuable pieces of information for you, the sponsor:

- The relative market caps of the ideas in the community offer a complementary counterweight to their pulse rates, which IdeaPlace calculates as a function of each idea’s rating and ranking. Wide swings between the two sets of values may indicate that the agency factor is in play. (Whereas the community members pay attention to the share prices of the ideas in which they invest, you, as the sponsor, care more about the relative market caps of the ideas. The market cap signals the extent to which the community believes the organization will implement the idea.)

- The market caps of the ideas in the community, relative to how evolutionary or revolutionary the ideas themselves would be for the organization to implement them, offer insight into how innovative—and, by extension, how risk averse—your community members adjudge your organization.

For example, if you believe that your organization’s culture supports risk taking, yet your community members have by and large invested in the most evolutionary ideas, then this seeming divergence may be indicating that your organization has a lower appetite for substantial change than you perhaps assumed. Does this mean that you should discount ideas that achieve a high market cap? No. It’s often the case that ideas that are fundamentally evolutionary in nature have the greatest chance of being adopted by the community. (The topic of the factors that enable or retard innovations from diffusing across communities is critical to understand in its own right. Please refer to Everett Rogers as a place to start your inquiry.)

In closing, the market cap that the community assigns to an idea from trading in it provides as important a signal to you as the sponsor as its pulse rate. Considering both sets of data gives you perspective on which ideas the community finds most compelling and which ideas the community believes the organization will most likely realize in their execution. As a sponsor you want the benefit of the larger view.

A Word to the Community Manager

The most common question community managers ask is not which ideation market should they choose, but rather when, or at what stage, should they begin the ideation market.

As with many of the important questions in life that confront and confound us, this one has no definitively right or wrong answer, but instead two schools of thought. One school of thought says that ideation markets should begin in the latter stages of an ideation challenge or, in a larger sense, the overall ideation process. Here, the ideation market serves to short list the short list of ideas that have run the gauntlet of the funnel, providing valuable insight into which remaining candidates the community believes that the organization will ultimately implement (please see the discussion of the agency dilemma directed at the sponsor). The other school of thought argues that starting the ideation market as early as possible makes the most sense. That way, the community has the most amount of time to trade and, in trading, set market-clearing prices that can help the sponsor more clearly see which ideas they anticipate the organization will implement. All markets need to achieve a certain level of liquidity and, for new communities, level setting before one can rely on the share prices as an indication of investor sentiment.

If you are new to ideation markets, you may want to start by initiating your ideation market in the second stage in your multi-stage community (i.e., a community whose funnel contains three or more stages, along with the final, closure stage). This approach enables you to devote the first stage to the process of crowd sourcing, in which you can combine a set of quantitative (e.g., page views) and qualitative (e.g., approval rating) benchmarks to the set of initial ideas to determine which achieve the second stage. In other words, let the community decide which ideas they choose to allow to enter the front door before you invite them to sit down for dinner.

Starting the ideation market in the second phase can, by way of general operation, allow your community members to have enough time to form and re-form their opinions about the relative merits of each idea, causing them to invest and re-invest, setting a market clearing price for each idea in the process.

In general, you want to consider when implementing your ideation market will likely give you the greatest amount of traffic—and thus, liquidity—over the longest period of time, so that the share prices and market caps can correlate to the evolution of the ideas themselves (i.e., do community members increasingly believe that the organization will implement an idea—or not). People invest in everything that comprises a complete idea, including the comments, the reviews, the votes, and the recruitment of team members, not just the original submission.

IMPORTANT NOTES

When trading is turned on (through the back end), the stage chosen for trading to begin and every subsequent open stage will allow trading. Early stages cannot be isolated for trading. The only way to isolate trading to a single stage is to turn it on just for the final, open stage.

Switching between market models (by switching from the earlier or later stages) once the Challenge becomes active and, in particular, once members have started trading ideas, can have negative consequences for the Challenge.

The following table depicts the sort of thought process you will want to ponder as you consider how to stage the ideation market for the community.

Table 1: Planning the Ideation Market

| Process | Time | Action |

| Market Model | Community Design | Decide on market model. Set all parameters and display options for that model by reading this guide. |

| Allow time for trading volume and liquidity to build so that market caps provide meaningful guidance. | Stage 1 | Allow the pool of initially submitted ideas to incubate and graduate by using the automated graduation criteria. |

| Stage 2 | Trading begins on ideas that graduated based on the qualitative and quantitative measures of crowd sourcing you set. | |

| Stage 3 | Trading continues on all ideas, including the ones that graduate to the next stage. | |

| Closing stage | Stage n+3 | Trading ends for the ideas that reach the closing stage. Community members receive payouts or forfeit investments on the idea in question. |

How to Set Up Ideation Markets

Set Up an Ideation Market

You need Administrator privileges to set the following attributes on your IdeaPlace site. In some instances your IdeaPlace community manager must set some of the attributes for you behind the scenes. This guide denotes those cases with DPA, which stands for Developer Product Access.

Take time to set up the ideation market for the community as part of the process by which you configure the overall site. Setting the site accordingly can help ensure that IdeaPlace assigns share values consistently, leading to a more consistent experience for community members.

Turn on Idea Trading

IdeaPlace provides the equivalent of a community-wide ON/OFF switch to enable and disable trading. It’s a useful setting to have when you want to stop trading and not have to worry about disabling all the supporting widgets and displays. It’s on by default. If you turn the switch off, community members can no longer participate in the ideation market. However, they do not lose whatever outstanding investments they may have had at the time.

Your community manager must check this setting for you (DPA).

- Idea Trading Enabled: checked to enable trading, the default setting

Decide the Initial Stage for Idea Trading to Begin

Decide the stage at which you want your ideation market to open for trading. Some choose a later stage in order to allow IdeaPlace’s automated graduation criteria to cull the more compelling ideas from the total population of incumbents in the first stage. Others want to make the ideation market an integral part of the process by which community members weigh in on ideas from the start. No one right or wrong answer exists for this question. Regardless, an idea leaves the ideation market when the community closes it.

IdeaPlace, by default, enables trading to begin at stage 3.

Your IdeaPlace community manager must set the value for the Idea Trading Stage parameter if you want to change the default:

- -1 = Stage 3, the default stage

- 0 = Stage 1

- 1 = Stage 2

- n + 1 = later stages

When the idea reaches the stage you have set for trading to begin, the Buy / Sell button appears on the idea’s home page (Figure 1).

Figure 1: The Buy/Sell Button appears on the Idea Home page (ViewIdea)

Assess the Settings for Currency and Rewards

Along with perhaps satisfying their intellectual curiosity, community members trade shares in the ideas because they want to gain additional units of currency that they can ultimately use to acquire whatever rewards you offer them, either through IdeaPlace’s Store capability or through some other means you manage outside the portal.

To this end, you want to think through the settings you apply for the Currency and, potentially, the Store functions on the Administration page, ahead of launching the community.

For example, IdeaPlace prices shares based on the probability that the community will implement the idea in question. In doing so, IdeaPlace takes into account where the idea stands in the funnel (ideas in the first stage have a lower probability of being implemented) and the momentum, or pulse rate, of the idea (ideas with lower pulse rates have a lower probability of being implemented). IdeaPlace assigns lower prices to ideas with lower probabilities of being implemented. You can adjust IdeaPlace’s pricing model by setting various limits, which the guide describes below.

In the market model, IdeaPlace will assign a share price of around 50 to a newly created idea with no established pulse rate. Here, the payout can approach 2:1.

A community member can earn substantial units of currency from trading and, in particular, from successfully predicting which ideas the organization chooses to adopt, especially if they invest early. This outcome is perfectly acceptable and supports the risk-reward model that underpins all markets. Further, you can limit the probability of large payouts by limiting how IdeaPlace assigns the initial share price. Community members are likewise limited in that they can only invest what they have earned (so, no buying on margin). Nevertheless, you will want to ensure that any newly minted tycoons within your community do not overwhelm your store or rewards system.

Market Model: Stock Market in which IdeaPlace Serves as the Market Maker

In this model, IdeaPlace serves as the market maker and community members must accept the price that IdeaPlace as the market maker sets or decline to make the trade.

IdeaPlace sets the initial price per share based on the pulse rate, or rating, of the idea, then continuously varies it based on the level of investment and number of investors in that idea relative to all other ideas in the market. For example, IdeaPlace would set the initial price of an idea with a pulse rate of 75 at 75 units of currency per share. You can scale the initial share price for ideas in the community’s ideation market by specifying a different default for the Scale Pulse Rate. Setting the default to 50 in this example would cause IdeaPlace to set the initial share price to 37.5 (75 x 50%). Your IdeaPlace community manager can change the default for this parameter (DPA).

- Scale Pulse Rate: 100%, the default percentage

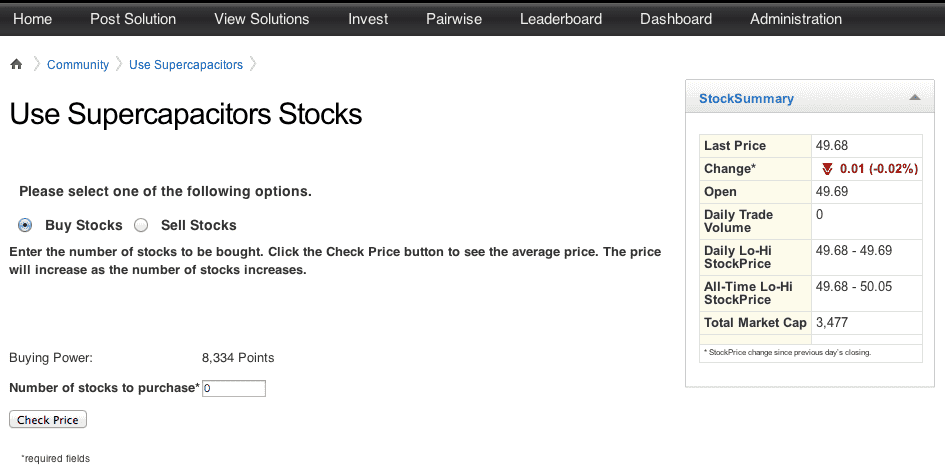

Figure 2 shows an example where the community member may choose to buy upwards of 120 shares of the idea in question, given they have 1235 units of currency, or buying power, available to them and IdeaPlace has set a market price of 10.14 units of currency per share. That said, please keep in mind that IdeaPlace, as market maker, may offer an initial price that ties to the idea’s pulse rate, as described above, and not the last price as shown on the Stock Summary widget. Community members must select the Check Price button to see IdeaPlace’s offer.

Figure 2: A Community Member prepares to buy shares

Your community manager must set certain parameters to activate this model.

- Default idea trading model: checked to apply the buy/sell model, default is checked

- Enable Bid/Ask Feature: uncheck to disable the Bid/Ask feature, default is unchecked

You also have the option of applying a tax in the form of a trading commission which IdeaPlace, as market maker, applies to each trade. The trading commission in this context can serve as a deterrent to speculative trading. Your community manager must set the commission if you want a different value than the default.

- Trading Commission: 0.01 per share for each transaction, the default charge

Setting Limits, Windows, and Weights

Setting User Investment Weighting

When using this market-based model, IdeaPlace gives you three ways to limit the relative weight of any one community member’s investment in a given idea.

The parameter, Trade Limit Idea Market Cap Pct, is perhaps the most straightforward option. For example, if the market cap of an idea is 4000 units of currency and you set the Trade Limit Idea Market Cap Pct parameter to 10%, then any one community member can invest at most 400 units of currency in the idea.

By comparison, the Trade Limit Avg. Net Worth Pct and Trade Limit Avg. Market Cap Pct parameters require you to grasp the average net worth of users and market cap of ideas, respectively. You can get a perspective on these values by running the standard member and ideas reports, then taking average values in Microsoft Excel. Relying on these parameters to achieve liquidity, however, would seem to demand that market sponsors manipulate the values with a remarkable, unnecessarily high of degree of subtlety.

You can set the parameters in the Idea Management function on the Administration page. IdeaPlace does not assign default values to these parameters. You must do so to put them in effect.

- Trade Limit Avg. Net Worth Pct.: Limit portfolio investment of a single user in an Idea to this percentage of the average net worth of users, if no other parameter overrides it

- Trade Limit Avg. Market Cap Pct.: Limit portfolio investment of a single user in an Idea to this percentage of the average market cap of ideas, if no other parameter overrides it

- Trade Limit Idea Market Cap Pct.: Limit portfolio investment of a single user in an Idea to this percentage of the market cap of the idea, if no other parameter overrides it

Further, you can specify how many shareholders in an idea exist before IdeaPlace enforces the above limits. The default setting is 0 to prevent the first investor from “cornering the market” in the idea. Your IdeaPlace community manager can set the value of this parameter for you if you want to change the default (DPA).

- Trade Limit Idea stock ownership Shareholder basecount: 0 shareholders, the default value

Setting Trade Windows

Buying and selling shares in an idea within short periods of time typically does not enrich a community member. Doing so represents a waste of their time and, potentially, currency. However, to reduce gamesmanship (in other words, speculating as opposed to investing thoughtfully), you can set trade windows. A trade window prevents a community member from selling shares in an idea that they bought within a certain amount of time from their purchase.

IdeaPlace does not set a trading window by default. To do so, specify a time in hours on the Trade Window field on the Idea Management function on the Administration page.

- Trade Window: time = 0 hours, the default value

Setting Idea Score Weights

You can specify the extent to which IdeaPlace factors the buying and selling of shares in an idea when calculating its pulse rate by setting the Idea Score Weight for Outstanding Shares which can be found in the Currency function on the Administration page. IdeaPlace gives Outstanding Shares a weighting of 4 by default, which represents an overweighting relative to the metrics of Conversational Level and Popularity and equal weighting with the third metric, Rating.

In concept, Rating and Outstanding Shares can reflect greater levels of authentic participation in an idea’s development and, thus, deserve overweighting. You use the pulse rate, by extension, to evaluate an idea’s ranking relative to all other ideas.

- Currency: Outstanding Shares = 4, the default value

Buying Shares

Turning on the Trading page

In addition to the Buy/Sell button on the View Idea page (see figure 1), a separate trading page can be linked to from the navigation bar. This page can be in three different formats.

Option One

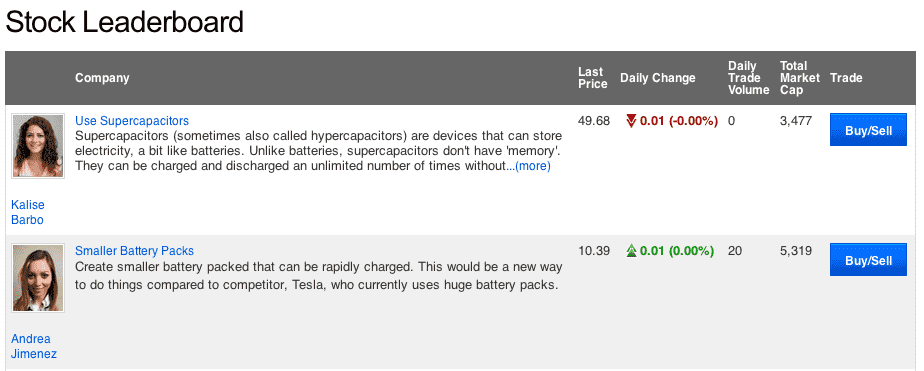

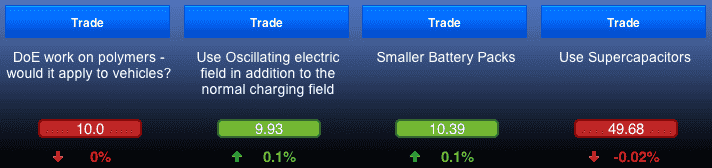

Figure 3: A Leaderboard-based trading display

This page is set up through the Site Editor in the Administration pages. Create a new page, then add the stock_leaderboard widget in the “blank” format. Ensure that the “Top level tab” box is checked if you would like the page to appear on the navigation bar. If you use this method to add the stock leaderboard to a page then you can add a text widget with some explanatory text to the same page.

To display this widget, you must check the Show "Stock Leaderboard" option which can be found in the Turn On/Off Features function on the Administration page.

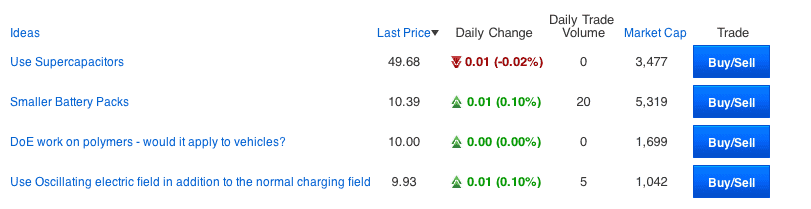

Option Two

Figure 4: A more visual display of Option One

This page is also set up through the Site Editor in the Administration pages. Find the "Invest" page in the Site Editor and check the "Top Level Tab" box to display the page on the navigation page. If "Invest" is not already in the Site Editor, create a new page and add the following to the “External URL” field: /Core/Rankings?type=9

This layout includes more idea information, but it is not possible to add a text widget to the page if you use this method.

Option Three

Figure 5: A stock market-themed board

To use this display, create a new page in the Site Editor then add the idea_market_electronic widget in the “blank” format. Ensure that the “Top level tab” box is checked if you would like the page to appear on the navigation bar.

This method also allows you to add a text widget with some explanatory text to the same page.

Buying and Selling

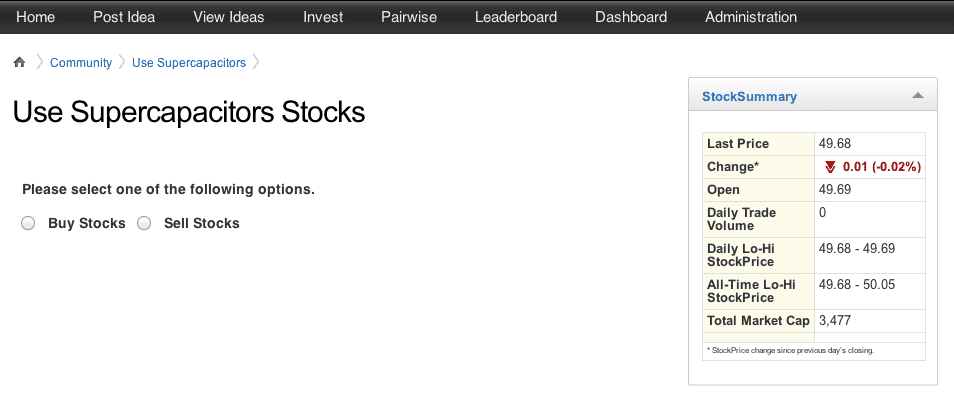

Once you have set the ideation market to begin at the desired stage, members can begin buying, selling, and investing in ideas whenever they reach that stage.

As with many other exchanges in the real world, you need cash on hand in the form of units of currency in order to bid on shares in an idea, purchase shares in an idea, or invest in an idea. IdeaPlace will not execute a purchase if you do not have the minimum amount of currency required.

You can earn currency by performing certain actions within the community, such as contributing an idea of your own. You can also earn currency when you redeem preferred shares granted by the owner of another idea. Of course, you must wait until the community successfully closes the idea in question before IdeaPlace credits your account. You cannot buy and sell preferred shares in an idea ahead of its closing successfully.

In the example below, with IdeaPlace as market maker, shares in the IdeasSchool EU idea are trading at 4.37. Thus, you would need at least 437 units of currency to buy 100 shares (Figure 3). Community members see this page when they select the Buy/ ell button on the Idea Home page, as shown in Figure 1.

Figure 6: IdeaPlace rovides share price information

Monitoring Your Portfolio

Once you invest, you will naturally want to keep track of your holdings. You can do so through the My Profile page, the View Ideas page, and the Leaderboard page. You will need to make sure that the appropriate widgets appear on each page. Alternately, you may also want to consider using the Site Editor to create a new “trading” or “trade” page as a higher level tab within the community to highlight the investment functions. This approach can help community members more readily identify the ideas that have become available for trading.

NOTE

Widget names are given in parentheses in the following sections.

My Profile Page

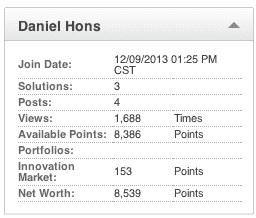

The User Stats widget (widget name = user_stats) on the Profile page displays two important pieces of information: Available Points and Innovation Market points. For example, Figure 7 shows that the user in question has 8,386 units of currency with which to buy additional shares in ideas that they find compelling and that they project will close successfully. They have 153 units of currency invested in their community’s ideation market at present.

Figure 7: The User Stats widget on the My Profile page

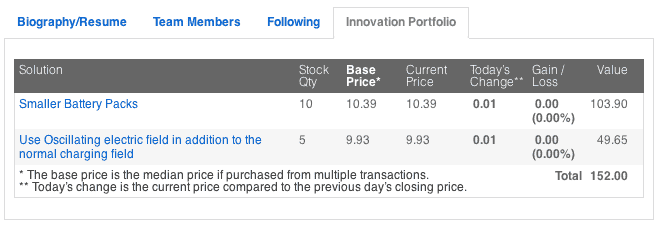

Your profile page also shows your investment portfolio with the Innovation Portfolio widget (widget name = stockportfolio_fresh) (Figure 8).

Figure 8: Your Innovation Portfolio on the My Profile page

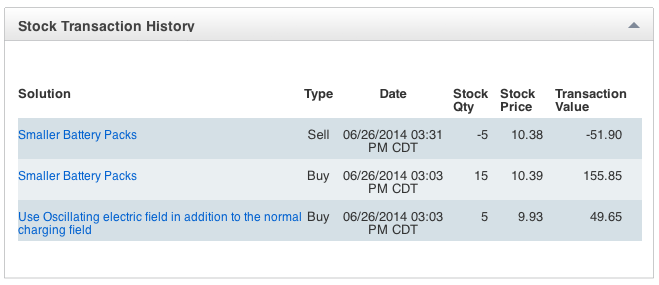

Last, you can view your transaction history on the My Profile page with the widget (widget name = transactionhistory) (Figure 9).

Figure 9: Your Transaction History on the My Profile page

The View Ideas Page

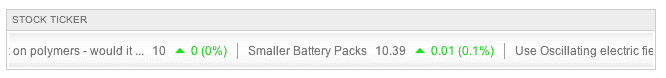

You can display a dynamic stock ticker that shows the market activity on the View Ideas page (widget name = stock_ticker). Placing the widget at the top of the page can, for example, make community members aware that they can trade in ideas that have reached the necessary stage (Figure 10).

Figure 10: The Stock Ticker

The Leaderboard Page

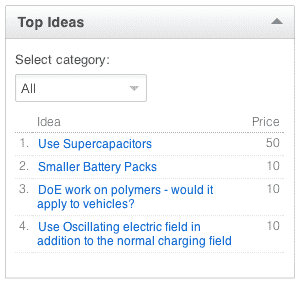

You can also display a narrow column version of the leaderboard reference above with the Top Ideas widget (widget name = highest_priced_ideas_by_category widget). This widget works well on the Leaderboard page, or in reality any page, with a narrow column which seems appropriate (for example, on the site’s Home page to increase the visibility of the Ideation market to the community).

Figure 11: The Top Ideas widget displays the highest-priced Ideas

Selling Shares

You have two opportunities to sell shares: at any time after you buy them (as long as that time comes after any trade window has been set for redeeming them) and at the time when the community closes the idea successfully, in which case the idea has gone the private company equivalent of “going public.” In this case, IdeaPlace credits your account with units of currency based on its calculation of the final price of the idea ahead of its being taken off the community’s ideation market.

IdeaPlace doesn't notify investors in an idea when the idea closes successfully. You do not receive the stock market equivalent of a confirmation notice from your broker. Instead, you must monitor the User Stats widget on the My Profile page to see how many units of currency you receive when this event occurs (i.e., the units of currency for Available Points increases and the amount in the Innovation Market decreases).

FAQs

Q1. Is it possible to have separate Stock leaderboards for two different stages of ideas?

A1. Unfortunately, we cannot customize the leaderboard to have separate stock leaderboards.

Q2. Can the base price of a single stock be configured? If yes, how?

A2. Yes. This can be done from the IdeaPlace side on the back end.

Q3. What happens to the idea when all the stocks of the idea are sold? Will the owner change, based on the stock ratio?

A3. When all stocks of an idea are sold, no more stocks can be issued. The Idea owners will not change.

Q4 What will happen to all the currency invested in a stock if an idea succeeds or when it is rejected?

A4. If an idea is closed successfully, the investing members will receive a points “bonus.” On the other hand, points are lost when demand for an idea goes down or when the idea is closed unsuccessfully.

Q5. Is it possible to have the trading ideas functionalities only for ideas belonging to one of the stages and not all ideas?

A5. Correct - The stages available for trading are managed from the IdeaPlace side on the back end.