Financial Planning overview

Introduction

Financial planning involves estimating the financial resources needed for a project, including costs, revenue, and funding. It focuses on creating a budget, assessing risks, and allocating resources to meet goals. Effective financial planning ensures informed decisions, keeps the project on track financially, and supports its success. Accurate financial planning is essential for project sustainability, profitability, and alignment with organizational goals. It helps manage costs, control risks, and achieve better outcomes.

AdaptiveWork provides a user-friendly way to manage project budgets, combining the ease of a spreadsheet with the structure organizations need for tracking resources at scale. With AdaptiveWork, you can monitor, control, and optimize project finances with ease, ensuring better decision-making and successful project outcomes.

Key features

-

Financial Planning

- Create budgets, forecasts, and financial plans for costs and revenues.

- Plan Capex/Opex spending and revenue tracking for billable projects.

- Easily integrate with systems like SAP or Oracle to track actual costs and revenues.

-

Financial Monitoring and Control

- Monitor expenses, revenues, and cash flows to stay within budget.

- Identify variances, address issues, and make adjustments.

- Use time-phased planning tools for cost control and forecasting.

-

Resource Allocation

- Allocate funds, personnel, equipment, and materials effectively.

- Track non-labor resources (e.g., travel, materials, equipment) with financial summaries by time period and project.

-

Cost Management

- Estimate, control, and report costs throughout the project. (monthly tracking of actuals)

- Optimize resources and address cost deviations efficiently.

-

Financial Reporting

- Generate detailed financial reports for stakeholders.

- Access data combining labor, non-labor costs, and financial timelines for a complete financial overview.

Key Objectives

Overall, the key objectives of project financial management and planning revolve around ensuring financial stability, controlling costs, managing risks, optimizing resource allocation, and delivering value to stakeholders throughout the project lifecycle.

- Budget Overruns: Without proper planning, you may underestimate the costs involved in the project. This can lead to budget overruns, causing financial strain on the project and potentially leading to its failure.

- Cash Flow Issues: Poor financial planning can result in cash flow problems. You may find yourself unable to pay vendors, contractors, or employees on time, which can harm relationships and hinder project progress.

- Risk of Project Failure: Financial planning helps identify potential risks and uncertainties. Without it, you may not be adequately prepared to handle unexpected expenses or economic downturns, increasing the risk of project failure. Contingency budget plan – steerco thresholds come into play to resolve budget contstraints

- Lack of Accountability: Financial planning provides a framework for accountability. Without it, it's difficult to track expenses, allocate resources efficiently, and hold team members accountable for their spending.

- Difficulty Securing Funding: Investors, stakeholders, or lenders may be hesitant to support a project that lacks a solid financial plan. Without demonstrating a clear understanding of the project's financial needs and potential returns, securing funding becomes challenging.

- Missed Opportunities: Effective financial planning allows you to identify opportunities for cost savings, resource optimization, and revenue generation. Without it, you may miss out on potential opportunities to improve project efficiency and profitability.

Workflows

Depending on your requirements, you can use Financial Planning for different workflows:

High-Level Budget Estimate

Detailed Budget Planning

Tracking Monthly Actuals

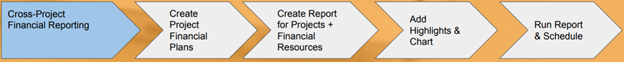

Cross-Project Financial Reporting