Supporting Revenue Recognition processes for Contracts

Revenue recognition in Professional Services Automation (PSA) requires alignment between contractual commitments, delivery execution, and financial accounting rules. While delivery progress is tracked through projects, milestones, and tasks, revenue recognition reflects how and when revenue is recognized for accounting and reporting purposes.

Contract Management provides the commercial framework that connects delivery activity with revenue recognition by consolidating work item–level revenue data under a single contractual agreement.

Revenue Recognition at the Work Item Level

Revenue recognition values are captured and maintained at the individual Work Item level.

Work items provide the operational detail required to:

-

Track recognized revenue based on delivery progress or completion

-

Apply milestone-based, time-based, or acceptance-based recognition logic

-

Reflect execution timing and delivery outcomes

Work item–level revenue recognition captures granular execution data and serves as the source for higher-level financial aggregation.

Revenue Recognition at the Contract Level

While revenue recognition is tracked at the work item level, it is aggregated and evaluated at the Contract level.

Aggregating revenue recognition at the contract level enables organizations to:

-

View total recognized revenue across all delivery work under a contract

-

Apply contract-level adjustments, amendments, or corrections

-

Reconcile delivery-based revenue with contractual and financial expectations

-

Support audit, compliance, and financial reporting requirements

The contract acts as the consolidation point for all revenue recognition activity related to the agreement.

Delivery Dates, Contract Dates, and Revenue Recognition Timing

Delivery dates on projects, milestones, and tasks reflect execution schedules. Revenue recognition timing, however, may be influenced by additional factors, including:

-

Contractual terms and recognition rules

-

Customer acceptance or approval events

-

Billing and invoicing schedules

-

Regulatory and accounting standards

-

External ERP or finance system controls

As a result, revenue recognition dates may differ from both delivery dates and contract dates. Contract Management provides the necessary context to evaluate and aggregate these factors across all related work items.

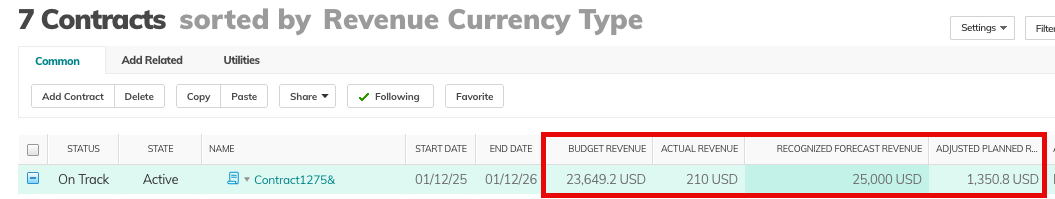

Aggregated Revenue Recognition Values

Contracts calculate aggregated revenue recognition values from directly associated work items.

-

Revenue Recognition Value

Aggregates recognized revenue from individual work items -

Adjustment Fields

Calculate contract-level revenue adjustments by comparing:-

Aggregated Actual Revenue

-

Aggregated Budget Revenue

-

Aggregated Revenue Recognition values

-

These adjustments support reconciliation between delivery execution and recognized revenue.

Integration Context

Contract Management establishes the structure required for integration with external ERP and revenue recognition systems.

-

Work items provide detailed revenue recognition data

-

Contracts aggregate and contextualize revenue recognition across delivery

-

External systems may apply additional accounting rules or adjustments

-

Contract-level aggregation supports auditability and financial consistency

This approach ensures PSA captures execution-level detail while enabling accurate, contract-based financial reporting.