AdaptiveWork process flows

Overview

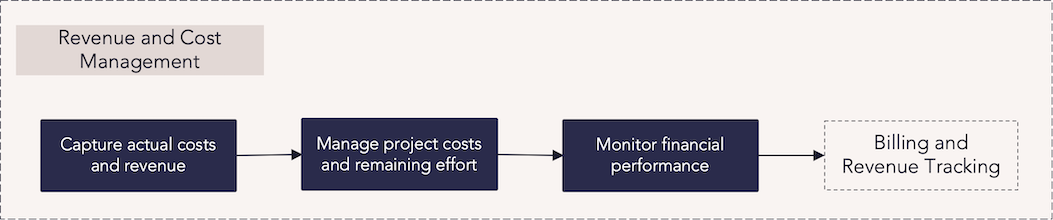

Revenue and cost management supports managing financial information for professional services engagements. As projects progress, their incoming costs and revenue can be compared against their original budgets and remaining effort to ensure they maintain profitability. When paired with the Billing and Revenue Tracking capability, it enables effectively billing engagements.

Process steps

| Process step | Description |

|---|---|

| Capture actual costs and revenue |

Update the financial plan with the financial actuals to capture an accurate representation of the project's revenue and expenditure. This information can be used in comparison with the project budget to track variances against estimated profitability. Labor actual costs and revenue for work items with the Time and Material billing type are automatically rolled up to the financial plan based on predefined resource rates. This information is typically captured from timesheets, but can also be added using the data loader or calculated from manual entries on the schedule. If the work item has a fixed price, the actual revenue will be updated with that value once the work item has been completed. Non-labor actual costs and revenue must be updated manually in the Financial Planning panel. For more information: |

| Manage project costs and remaining effort |

Ensure the work and financial plans are updated to accurately reflect work items that have been completed in addition to the remaining resource efforts and costs required to deliver the project. This up-to-date information helps managers accurately forecast cost versus revenue and understand financial variances to safeguard the project’s profitability. For more information: |

| Monitor financial performance |

Monitor and compare the budget cost and budget revenue with the actual cost and actual revenue to track the project’s progress and any financial variances. The Project Financial Highlights and Project’s Percentage Complete visualizations can be used to monitor the project’s financial performance and overall profitability. Project financial information can also be analyzed in greater detail by adding relevant financial fields into the Work Plan panel or by creating reports and constructing dashboards. Utilize this data to help make informed decisions and manage exceptions. |

Reports

There are several standard financial reports in the report library. These can be run with specific filters to see the appropriate financial information. See Financial Planning Report Examples and Timephase Financial Data in Reports and Dashboards for more information.

Additional reports and dashboards can be created by the administrator and shared with the organization and appropriate team members.

Best practices

Maintain accurate data

Financial plans need to be accurate so appropriate decisions can be made. This includes the original project budget and the ongoing tracking of actuals against the budget. For actual costs and revenue that are not automatically loaded, managers should ensure they are consistently updating the financial plan with the most current information to enable accurate analysis of how projects are performing to plan.

Establish clear cost controls

Cost control is essential to ensure engagements stay on track, avoid cost overruns, and maximize revenue. After the planning process, opportunities should have accurately defined cost and billing rates to create an expected revenue. During execution, variance tracking of actual costs to plan, maintaining change control, and applying other cost control measures allow for the early identification of overspend.

Accurately track labor costs

Labor costs are one of the highest expenses organizations face. Accuracy can be ensured by defining resources as employees or contractors and setting specific rates by resource type, role, or individual. There should be a clear process for allowing rate overrides only when necessary and for correctly tracking the added cost of overtime.

Log time and expenses

Time reporting is critical for services organizations as it forms the basis for billing customers for work, while expense tracking enables billing for additional costs, such as travel for a training event. Capturing and tracking both time and expenses is essential to maintain profitability.

Create a single source of truth

Organizations should standardize financial processes to ensure the platform becomes the single source of truth for financial tracking. Integrated tools and standardized processes enable accurate decision-making and a clear understanding of the financial status of each project and the entire portfolio.

Manage revenue and performance

An integrated billing and work strategy helps maximize project profit, promote visibility, and drive performance. Managers should closely monitor margins and performance and be prepared to quickly adjust based on organizational guidelines.

Re-baseline financial plans

When there is an approved change to a project’s financial plan, save the new plan as the current baseline. Storing each change as a separate baseline provides a record of financial progress and adjustments, improving budgeting accuracy over time.

Monitor financial health

Using the right reporting and dashboards to monitor the financial health of both individual projects and the overall portfolio is critical. Reports should be consistent, accurate, and easy to understand, empowering leadership to track performance and make timely, informed decisions.