Portfolios process flows

Overview

This guide will walk you through the process of setting up and managing financial targets for your products, including defining labor and non-labor costs, setting revenue and benefit expectations, and establishing a financial baseline in Planview Portfolios. Additionally, we will explore the reporting and analytics tools available to track and analyze your financial data, helping you assess the impact of changing demand and keep your financial targets aligned with business objectives. Whether you're managing ongoing products or planning for new investments, this guide provides the steps and best practices needed to manage your product funding effectively.

New to product funding? Check out this demo video for a quick introduction:

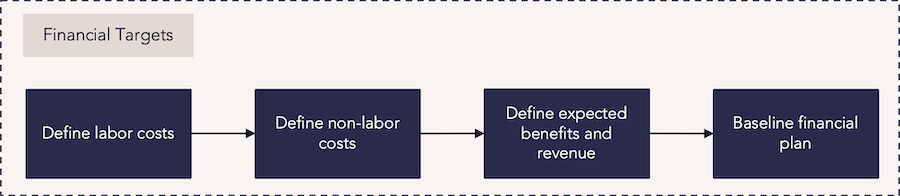

Process steps

| Process step | Description |

|---|---|

| Define labor costs |

Enter the cost targets for labor into the outcome financial plan. Budgets may be created at any level of the Outcome structure on the Financial Planning Detail screen then spread down to lower levels or rolled up to higher levels. Alternatively, data may be loaded using an outcome financial load, then rolled up and edited. For more information: |

| Define non-labor costs |

Enter the non-labor costs into the outcome financial plan. These costs should be divided into the appropriate non-labor categories. Non-labor data is often entered manually, then spread down to lower levels or rolled up to higher levels as part of the larger budgeting process. |

| Define expected benefits and revenue | Enter the revenue targets and benefits for launching the product. These targets and benefits can be manually entered into the outcome financial plan. |

| Baseline financial plan | Following the input or roll-up of the financial plan budget and target data, a financial baseline for the financial plan should be taken to compare and track variances of the product financials over time. |

Reports

How are we able to see our financial targets for benefits and costs?

| OUT31 – Outcome Portfolio Revenue and Cost Analysis | Analytic | This report analyzes program data and summarized portfolio financial plan data, with effort represented as FTEs, days, and hours, and financials as cost, benefits, and revenue. The report uses a single version of the financial plan and a data type based on project attributes, account structure levels, or line attributes of selected accounts. You can configure the report to run against each level in the strategy structure. |

| Analytic |

This report can select cost or revenue-based measures from the financial planning data to drive bubble size and visualize the outcome pipeline. You can configure the report to run against each level in the outcome structure. |

|

| Analytic | This report analyzes the risk and reward balance across the outcome portfolio. You can select revenue measures for the x-axis, risk-based attributes for the y-axis, and cost-based measures for the bubble size. |

How are we able to understand how changing demand impacts our financial targets?

| Outcome Portfolio – Portfolio Manager – Financial Variance Column Set | Tile | This column set allows you to compare financial variances between an outcome's forecasted and actual costs. |

| Analytic | This report allows you to compare versions of the outcome and summarized portfolio financial plan data, with effort represented as FTEs, days, and hours, and financials as cost and revenue. A burndown chart is included for the whole portfolio and each initiative. You can configure the report to run against each level in the strategy structure. |

Best practices

Align budgets to outcomes

Align funding to your business outcomes to ensure that the end-to-end delivery of your products can be managed more effectively and flexibly. This encourages greater flexibility and autonomy within your value streams, teams, and teams of teams.

Create guardrails for spending

Once you align your budget with your outcomes, create guardrails that define spending policies, guidelines, capacity, and practices across the portfolio. This ensures that the right investments are made within each budget while giving teams the freedom to weigh new opportunities against long-term strategies.

Reassess budgets often

Reassess your budget regularly to analyze investments across value streams and reallocate funds to new initiatives. Continuously monitoring your portfolio enables you to pivot toward new opportunities or away from unsatisfactory projects with greater flexibility and ease.

Budget collaboratively

Create a better-informed and effective system for distributing investments by involving stakeholders and business owners in the budgeting process. Participatory budgeting encourages leaders to share resources to achieve results within their initiative.

Use scenario planning

Scenario planning helps to forecast the cost and benefits of a given selection of product investments. Create and assess various scenarios of different product mixes to ensure the products you choose to invest in can achieve your organization’s strategic goals.