AdaptiveWork process flows

Overview

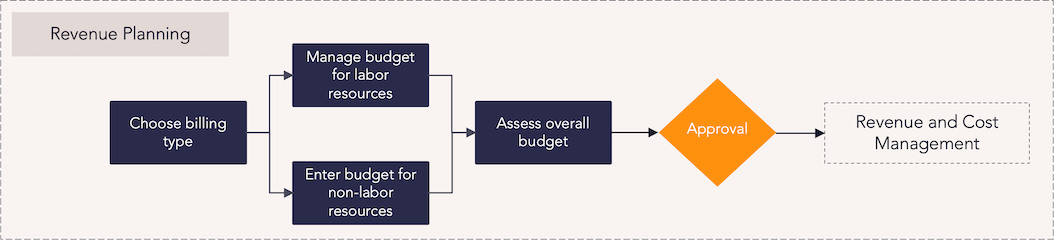

Revenue planning supports the planning and management of financial information for professional services engagements. Different sets of financial data can be managed at key approval and governance points, providing a standard for measuring performance, including the creation of high-level estimates and baseline budgets. When paired with the Revenue and Cost Management capability, it allows for detailed planned reporting versus actual variance reporting.

Process steps

| Process step | Description |

|---|---|

| Choose billing type |

Choose the type of billing the project will use. The project’s Billing Type will be used to create the budgeted revenue, which can be calculated in three ways:

For non-billable projects, budgeted cost and expected revenue can be manually updated in the finance section of the project’s Properties card. For more information: |

| Manage budget for labor resources |

Plan resource costs and revenue by assigning resources to billable tasks with planned hours. This process typically takes place as project managers create their work breakdown structure. If the project uses fixed prices for billing, the value of the project or milestones should be set in the Fixed Price field. A value for Fixed Cost may also be added. Use the Financial Planning panel to view the Budget Revenue and Budget Cost columns for labor. These columns automatically calculate the cost and billing rates for the hours resources are assigned on active work items, along with any fixed costs or revenue. Ensure the work schedule captures hours assigned to resources and that work item value and resource rates are accurately set. For more information: |

|

Enter budget for non-labor resources |

Enter the budget for the non-labor resource costs required to deliver the work into the Financial Planning panel. Revenue or benefits from non-labor resources may also be added. All updates to non-labor resources must be manually entered into their corresponding columns. For more information: |

| Assess overall budget |

Assess the overall project budget using the Financial Planning panel for a time-phased summary, which includes costs and revenue for both labor and non-labor resources. When the project budget is finalized, it may be assigned to a reviewing authority. For more information: |

Reports

There are several standard financial reports in the report library. These can be run with specific filters to see the appropriate financial information. See Financial Planning Report Examples and Timephase Financial Data in Reports and Dashboards for more information.

Additional reports and dashboards can be created by the administrator and shared with the organization and appropriate team members.

Best practices

Plan around the business model

Base financial plans on the business model of each opportunity to maximize revenue and minimize costs. Establish clear planning guidelines for different models—such as fixed fee or time and materials—to drive project-level profitability and portfolio-level revenue visibility.

Leverage historical data

Use past engagement data to refine future forecasts. Analyze where previous projects succeeded or deviated to improve margin accuracy and strengthen financial planning for similar initiatives.

Establish governance

Implement portfolio-level governance processes to monitor engagement planning and revenue forecasts. Use automated reports or dashboards from an integrated system to track financial plans, billing, and costs throughout project execution.

Create a single source of truth

Standardize financial processes and integrate systems to ensure consistent, accurate project tracking. A unified financial platform eliminates errors, reduces rework, and enables better decision-making across the portfolio.

Find the right staffing balance

Maintain an optimal mix of employees and contractors to stay flexible with changing demand. Regularly review staffing ratios to balance labor cost savings with operational effectiveness.

Budget non-labor expenses

Account for non-labor costs such as travel, supplies, and technology in the financial plan. Predefine expense categories to improve planning accuracy and ensure complete, billable project cost tracking.

Keep resource rates up to date

Track and update resource rates regularly to reflect current costs and billing expectations. Communicate changes promptly to project managers to maintain accurate financial plans and protect e