AdaptiveWork process flows

Overview

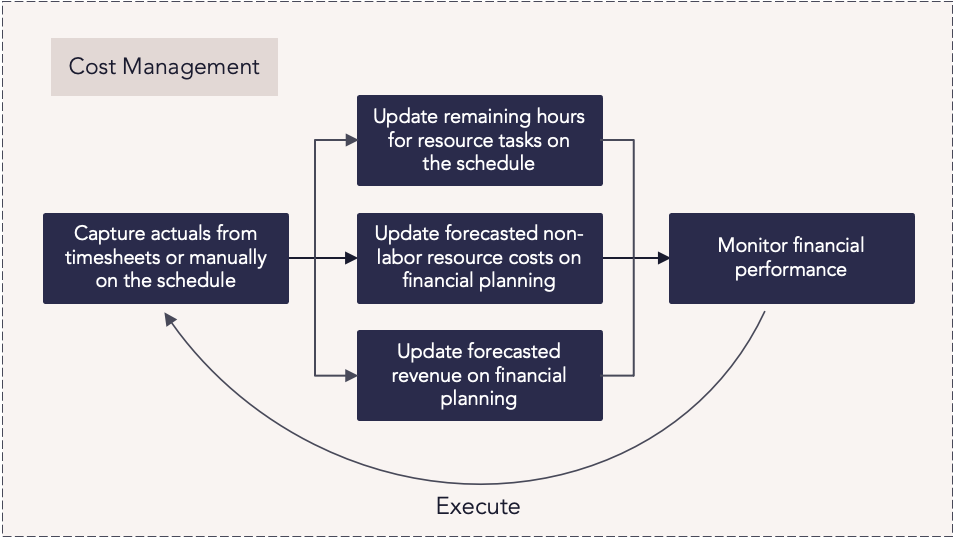

This guide provides a comprehensive walkthrough of how organizations can use Planview AdaptiveWork to manage project costs with precision and transparency. Learn how to capture actual costs, forecast labor and non-labor expenses, and monitor financial performance against budget. You’ll explore key processes like loading actuals from timesheets, updating resource and non-resource forecasts, and tracking predicted benefits and revenue.

Whether you're refining estimates or managing exceptions, this guide includes the steps and best practices you need to stay on top of your financials and make informed decisions throughout the project lifecycle.

Process steps

| Process step | Description |

|---|---|

| Capture actual costs |

Refresh the financial plan with the actual costs incurred to capture an accurate representation of the project's expenditures. This information can be used as a comparison against the project budget to track variances against the estimated spend. Costs can be loaded from timesheets or loaded from manual entries on the schedule (work breakdown structure). Labor costs from timesheets are calculated based on defined labor rates and time entries. For more information: |

| Manage forecasted resource effort and costs |

Ensure the financial plan accurately reflects the estimated resource costs and effort required to deliver the project or program. This up-to-date cost and effort information helps managers understand the impact of the pending resource costs. Make sure that resource demand and assignments information on the schedule are current to ensure that the financial plan accurately represents the forecasted costs. For more information: |

| Manage forecasted non-resource costs |

Ensure the project financial plan accurately reflects the estimated non-resource costs required to deliver the project or program. This helps managers provide an accurate forecast of the predicted expenditure. For more information: |

|

Manage forecasted benefits and revenue |

Ensure the project financial plan accurately reflects the estimated benefits to provide an accurate forecast of the predicted revenue. |

| Monitor financial performance |

Track the current performance of the financials against the original budget and use this information to make informed decisions and manage exceptions. |

Reports

There are a number of standard financial reports in the report library. These can be run with specific filters to see the appropriate financials. See Financial Planning Report Examples and Timephase Financial Data in Reports and Dashboards for more information.

Additional reports and dashboards can be created by the administrator and shared with the organization and appropriate team members.

Best practices

Build a single source of truth

Organizations should strive to standardize their financial processes so that the platform becomes the single source of truth for tracking all costs and benefits. When everyone is using the same processes and categories to define costs and benefits, you’ll be able to make accurate decisions and understand the financial status of each project and the entire portfolio.

Maintain accurate data

Financial plans need to be accurate so appropriate decisions can be made. This includes the original project budget and the ongoing tracking of actuals against the budget. For actual costs and benefits that are not automatically loaded, managers should ensure they are updating the financial plan in a timely fashion and with the most current information to enable accurate analysis of how projects are performing to plan.

Establish clear cost controls in planning

Cost control is established to ensure investments stay on track, do not experience cost-overrun, and maximize revenue and benefits. During planning investments should have accurately defined fixed versus variable costs, cost of labor and materials and the expected ROI. Within execution variance tracking of actual costs to plan, having change control established, and any other cost controls in place will allow for easily identifying areas of overspend to which strategic decisions can then be made on the investment portfolio.

Accurately track labor costs

Labor costs are one of the highest expenses organizations contend with. Organizations can ensure their labor costs are accurate by: defining resources as employee or contractors; having specific rates set up by resource type, role or named individual which are time-boxed; allowing for rate overrides to be set when needed; and correctly tracking added cost for overtime.

Understand contractor and employee ratio and costs

Organizations should periodically review the ratio of contractors to employees and the related cost to maintain the "happy balance" of labor cost savings and peak functionality.