AdaptiveWork process flows

Overview

This guide provides a step-by-step overview of how organizations can use Planview AdaptiveWork and the financial planning capability to forecast costs, estimate benefits, and build budgets that support strategic investment decisions. Learn how to develop business cases, track planned vs. actuals, and use reports and dashboards to monitor financial performance across portfolios, programs, and projects.

Process steps

| Process step | Description |

|---|---|

| Enter initial estimated cost and revenue |

In the Finance section of the project enter the initial Budgets Cost and Expected Revenue. If timesheets are not being used, the Actual Cost and Actual Revenue can be manually entered or calculated from manual entries on the schedule. For more information: |

| Enter planned hours for resources on tasks on the project schedule | Project managers plan resource costs by creating their detailed schedule (work breakdown structure) and assigning the needed resources to tasks and assigning planned hours. The financial plan Labor Budget and Forecast are the calculated using those tasks, resources, assigned hours and the respected resource rate. |

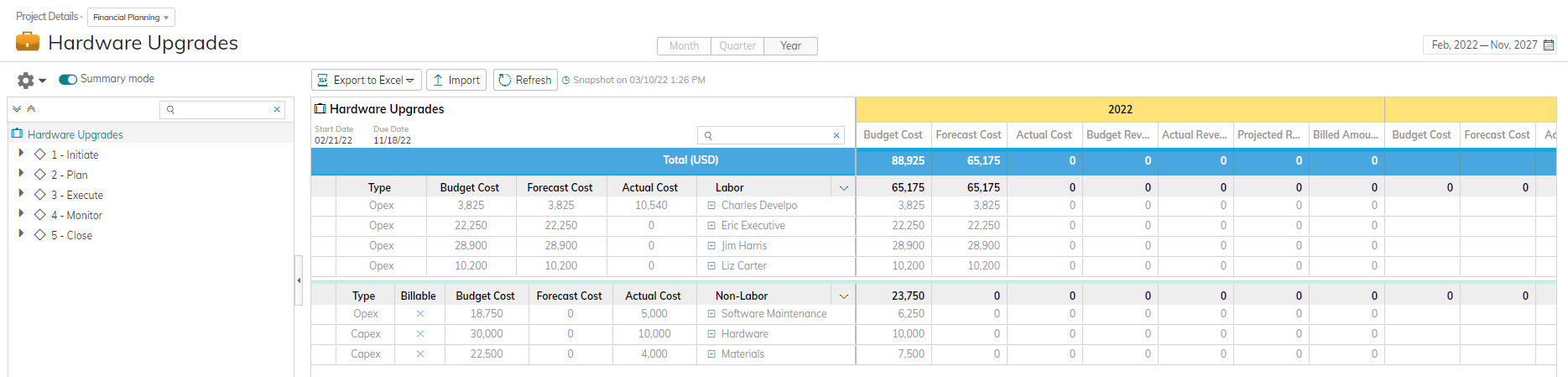

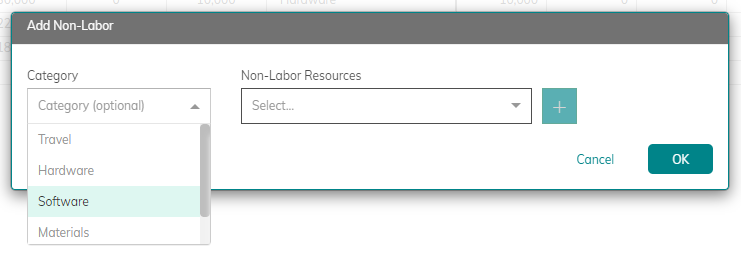

| Enter budget for non-labor resource costs on financial planning |

Enter the budget for the non-labor resource costs required to deliver the work into the financial planning. For more information: |

| Enter budget for forecasted revenue on financial planning | Enter the budget for the financial benefit of delivering the work into the financial planning. |

| Budget approved/forecast entered | The final project budget is reviewed and approved. Once approved, the Budget totals are entered into the Forecast. This allows tracking of Budget versus Forecast to track the progress of the project or program. |

Reports

There are a number of standard financial reports in the report library. These can be run with specific filters to see the appropriate financials. See Financial Planning Report Examples and Timephase Financial Data in Reports and Dashboards for more information.

Additional reports and dashboards can be created by the administrator and shared with the organization and appropriate team members.

Best practices

Build a single source of truth

Organizations should strive to standardize their financial processes so that the platform becomes the single source of truth for financial tracking. When everyone is using the same processes and categories, you’ll be able to make accurate decisions and understand the financial status of each project and the entire portfolio.

Fund programs strategically

Prioritize and fund program investments based on quantifiable business benefits, such as ROI, NPV, and customer retention metrics.

Give each value stream a budget

In agile organizations, define spending policies, guidelines, and practices for each value stream within the portfolio. With these guardrails in place, each value stream should have autonomy, flexibility, and the speed to execute their own budget.

Monitor financial health

Having the right reporting and dashboards that display the financial health of both individual projects and the overall portfolio are necessary to ensure the right decisions are made when a project starts to deviate from the plan.

Baseline financial plans

When there is an approved change to a project’s financial plan, save off the new plan as the current baseline. Having each change to the plan saved as a separate baseline allows you to see the progress of financial changes, and when looking back, see adjustments during a project’s initial planning to allow for more accurate budgeting.

Understand top-down and bottom-up

Organizations can use top-down planning (where a pool of funding at the program or strategic level is used to fund the work aligned against it), or bottom-up (where the work is funded and then rolled up to appropriate levels to see the overall costs or benefits). Understanding how your organization tracks and approves funding is important to know what guardrails are in place and what reporting will be used to track financial performance.