Project Portfolio Planning

Project Portfolio Planning

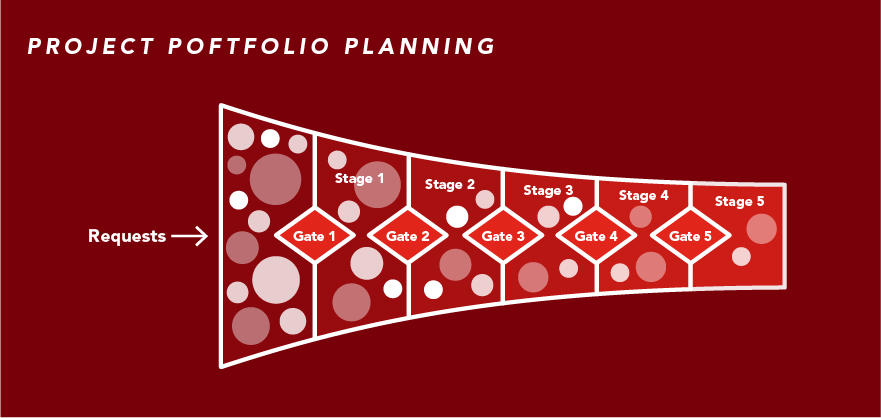

This capability supports a clear and consistent process for initiating new business requests, managing new projects, and progressing projects through an approval cycle into execution and delivery. When new projects are created, description and categorization information is captured, then a high-level work schedule is built out with dates, durations, milestones, and other important information. A high-level estimate of project costs and benefits are captured in the financial plan, then baselined to track progress on project delivery, business outcomes, and important program milestones.

Learn more

Capability resources

AdaptiveWork process flows

Review step-by-step guidance, process flows, and best practices for end users to achieve specific business outcomes.

Learn more

Connected ProjectPlace process flows

Review step-by-step guidance, process flows, and best practices for end users to achieve specific business outcomes.

Learn more

Portfolios process flows

Review step-by-step guidance, process flows, and best practices for end users to achieve specific business outcomes.

Learn more

Business Requests

Business Requests Project Planning

Project Planning Project Governance

Project Governance